Our

progress

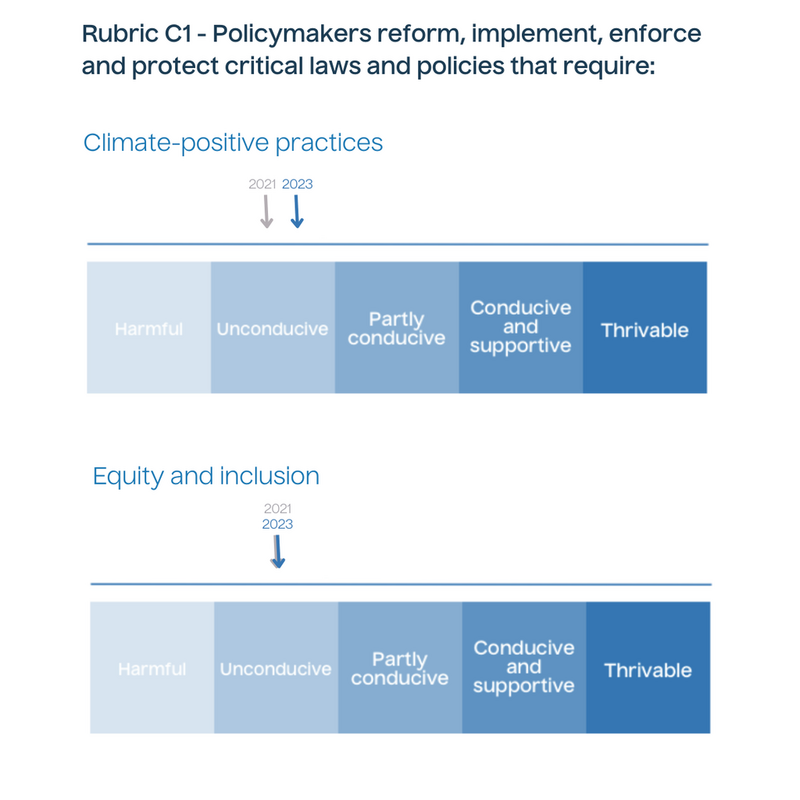

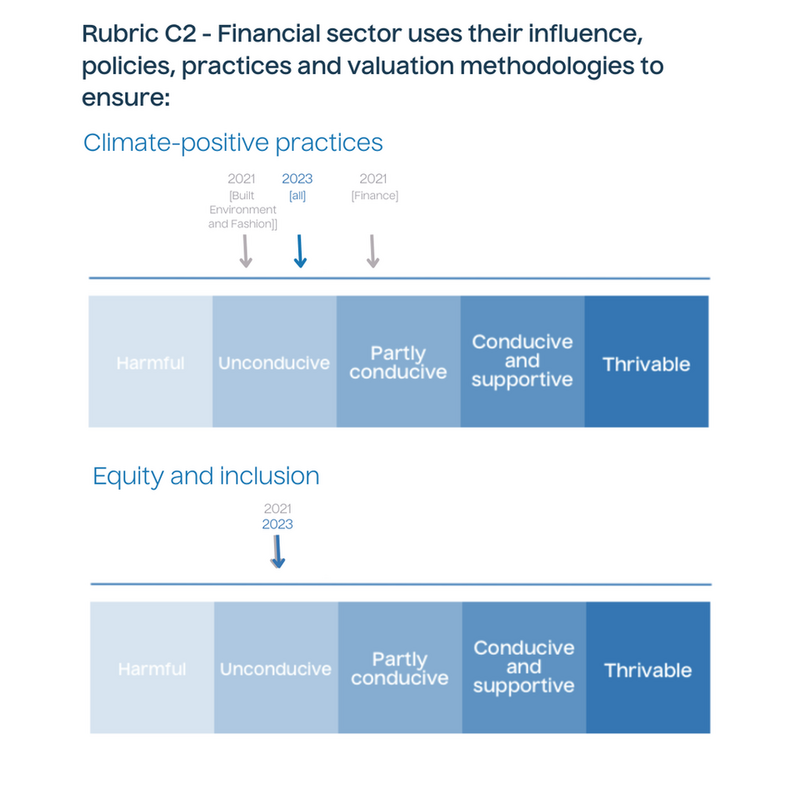

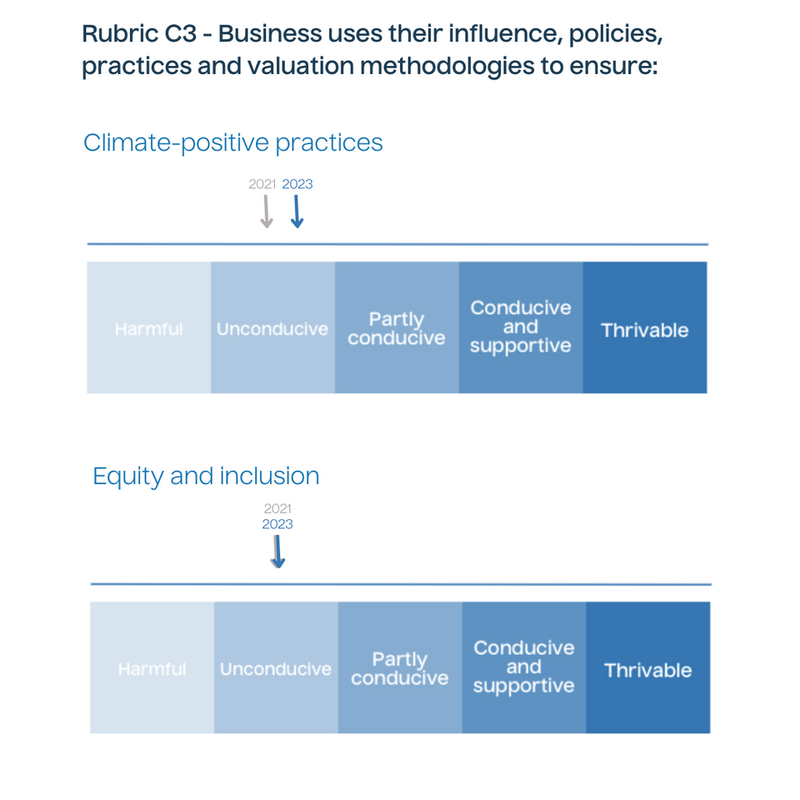

Since our systems baseline assessment, in 2021, to determine industry needs by 2025, progress has been challenging. Yet, we and our partners see positive signs that suggest change is occurring in finance, fashion, and the built environment.

Read more

Measuring our contribution

to systems

change

The overall status across the outcomes was rated as 'unconducive' and ‘stable’ in 2023 due to the slow pace of change.

Critically, the evidence we collected over the last year has influenced our strategic pivot from addressing climate and inequality to focusing on just transition in industry. Furthermore, it also informed how deepening the integration of finance, labour rights and narratives would help accelerate change.

We will continue to draw on evidence in our ongoing work to revise our strategy, Theory of Change and desired outcomes throughout 2024 and 2025.

⇒ Developments and concerns per industry.

Fashion

Positive developments:

Momentum for fashion sector regulation has gained pace. Policies for a more climate-positive and just fashion industry are being developed in the EU, including human rights due diligence, addressing greenwashing, product traceability, and sustainability and circularity. Laudes partners have played a significant role in improving the regulatory landscape.

Concerning:

Policymakers and business are placing a greater focus on climate-positive practices than on addressing inequality and labour rights, despite growing just transition narratives and commitments.

Built Environment

Positive developments:

Policymakers increasingly recognise the importance of action on whole-life carbon and circularity, and EU-wide policies are under development. Laudes partners have made significant contributions to strengthen and accelerate the EU Energy Performance of Buildings directive.

Concerning:

The policy measures taken are just the beginning of what is needed. Only a few countries and cities have caps on whole-life carbon (WLC) but more rapid scaling is required. The appetite for regulation addressing the equity and inclusion of workers and communities has been muted, so far.

Finance and Capital Markets

Positive developments:

The EU is making real progress on monetary policy, bank regulation and supervision, and reporting requirements on sustainable finance. Laudes partners have contributed significantly to many of the changes, particularly with Central Banks.

Concerning:

EU businesses are pushing back on new policies and regulation may be watered down by corporate lobbying and populist pressure.

There are few visible signs that equity and inclusion are gaining sufficient traction to address inequalities.

⇒ Developments and concerns per industry.

Fashion

Positive developments:

Financing for next-gen materials and regenerative landscapes has increased since 2020/21. Over EUR 2bn has been unlocked to support pilot projects with strong contributions from Laudes partners such as Fashion for Good.

Investor interest in ethical fashion is growing, although this is at a nascent stage.

Concerning:

Financial support to take next-geneneration materials to scale remains insufficient as the financial factors for maintaining the ‘status quo’ still dominate.

Influencing finance to incentivise human and labour rights is less apparent than for environmental issue

Built Environment

Positive developments:

New products are being developed to mobilise finance for energy efficiency in commercial and residential real estate. Green bond issuance by the buildings sector is increasing. Laudes partners, such as the Green Finance Institute, have contributed to enabling the roll-out of financial products to support energy efficiency scaling in buildings.

Concerning:

Interest in climate change and ESG from investors does not translate into pressure on banks and businesses (e.g. lower interest rates for low-carbon building projects). Communities and workers do not feature strongly with built environment investors. There is a general resistance to changes in practice that favour residents and workers and reduce profits and/or increase costs for investors and developers.

Finance and Capital Markets

Positive developments:

Despite the ESG backlash, there are encouraging signs from the broader consideration of climate risk by Central Bankers, in monetary policy and harmonised frameworks, and the expansion and maintenance of proxy resolutions made by shareholder groups at corporate AGMs.

Laudes partners’ contributions have supported work across Central Banks, and the use and standardisation of metrics for judging climate and transition performance.

Concerning:

Very few financial actors use their influence, policies, practices and valuation methodologies to ensure climate-positive and socially equitable practices. Investors demand that companies maximise profit first rather than consider climate and inequality systematically.

With rare exceptions, banks and institutional investors have continued lending to, investing in or underwriting new (or existing) harmful assets.

⇒ Developments and concerns per industry.

Fashion

Positive developments:

Laudes partner Canopy has removed almost all old-growth forest wood from cellulosic materials by working with brands and suppliers. This demonstrates that accountability and transparency can drive change at scale.

Other Laudes partners have contributed to raising transparency down the supply chain, which has moved from ‘niche’ to ‘norm’.

Concerning:

Barriers to change are blocking the transition on climate and addressing labour rights. Most significant are pricing and cost, insufficient corporate leadership, a focus on short-term returns and adherence to established linear business models.

Built Environment

Positive developments:

There is growing pressure on business to implement climate-positive policies from policymakers, clients and residents. Leading businesses are adopting targets for scope 3 emissions. Laudes partner Built By Nature seeks to reduce barriers to the use of bio-based materials in construction.

Social value in the built environment is beginning to get on the agenda of policymakers (e.g. EU Green Deal).

Concerning:

The industry is not on track to meet net-zero emissions targets by 2050 and emissions have risen above pre-pandemic levels. There is little pressure from mainstream investors to adopt climate-positive practices. Low-carbon buildings are still more costly and more complex than conventional buildings to design, finance, insure and build which inhibits scaling.

Finance and Capital Markets

Positive developments:

The number of climate-related shareholder resolutions has grown significantly, as has investor engagement with the companies causing the greatest environmental damage. Evidence suggests that just transition issues are beginning to be more closely linked to climate issues. Laudes partners contributed to the inclusion of just transition indicators in the Net Zero Company Benchmark for the first time in 2022/23. |

Concerning:

Few corporates across the financial industry offer intermediate targets for how their net-zero commitments will be delivered, have systems to robustly measure progress, or use Paris-aligned business plans to guide the process. An increasing number of banks are diluting their commitments on climate.

There is little evidence of an appetite for businesses to link climate and equity/inclusion issues strategically or operationally. Standardisation, quantification and reporting of the ‘S’ in ESG remains difficult, complex and variable.

⇒ Developments and concerns per industry.

Fashion

Positive developments:

Increased awareness among actors (policy makers, CSOs, worker unions) that a transition towards a more sustainable and circular fashion industry needs to be just.

Laudes partners are advocating for robust environmental regulations and human rights due diligence, with a focus on including local community and worker voices.

Concerning:

Awareness and expertise on just transition is still limited and more progress is needed to turn key perspectives into actionable knowledge and concrete policies. There is no strong evidence of an augmentation of worker and producer voices on climate, particularly in Bangladesh and India. There has been some erosion of union and worker rights in producer countries, notably during the pandemic.

Built Environment

Positive developments:

There is some community activity to influence and control development (e.g. Community Land Trusts). Laudes supports several promising pilots on equity and inclusion but there are no clear results yet or pathways for scaling. Concerning: Workers and producers have been a low priority for the industry concerning climate and tackling inequalities. |

Finance and Capital Markets

Positive developments:

Coalitions of civil society groups are influencing policy, particularly around climate issues in the EU. Laudes partners have contributed to a growing understanding of key financial policy issues concerning climate.

Concerning:

Public resistance to the financial implications of green policies has grown due to rising costs of living. There has been little coalescence linking climate and equity.

A siloed approach has dominated, but these can be broken down as the policy and financial narrative switches to just transitions..